Annual Report 2024

ART MEETS IMPACT

We see financial services as more than just transactions and numbers—they’re about community, growth, and connection. That’s why we incorporated the stunning artwork from a mural we commissioned last year into this report’s design.

With support from Visa’s community improvement funds, we partnered with The Broad Strokes Project of Longview to commission a mural on the building next to our Main location at 822 Commerce Ave in Longview. Denver-based artist John Hastings created Season Stir, a mural celebrating native Washington flora, wildlife, and the dynamic beauty of Pacific Northwest weather.

By weaving this visual masterpiece into our report, we’re celebrating not only our achievements as a credit union but also the creativity and culture that make our communities unique. Just as our financial services create meaningful impact, great art tells a powerful story—and we’re proud to share ours with you.

ACCOLADES

Jack Henry & Associates

Cobalt Barrier Breaker Award winner

Tillamook Headlight Herald’s Readers’ Choice Awards:

Best Financial Institution

DepositAccounts DepositAccounts.com

Grade A Health & Stability rating

The Daily News’ Best of Lower Columbia Awards:

- Best Bank or Credit Union

- Best Employer (Over 50 Employees)

- Best Customer Service

- Best Mortgage Company

- Best Financial Advisor: Breta Grumbois

The Daily News’ Best of Lower Columbia Awards:

- Best Credit Union

- Best Place to Work

- Best Community Partner

- Best Financial Advisor: Breta Grumbois

COMMUNITY IMPACT

Donations & Sponsorships

$480,620

donated

284

donations

165

organizations

$29,975

donated

Financial Education

3,754

people reached through financial education efforts

2,537

hours of financial education provided to children and adults

17

in-person financial education presentations

Fibre Family Volunteerism

236

volunteers

1,856

organizations

957

volunteer shifts

79

organizations

90

community events we ran or helped host with partner organizations

Overall Credit Union Economic Impact

WASHINGTON

5.5 million credit union members

$4 billion contribution to gross domestic product

$759 million in direct member benefits

$24.1 billion in home loans

$382 million deposited in youth savings accounts

12,100 family wage credit union jobs

78,000 hours of community service by credit union employees

3,000 non-profits supported

OREGON

2.3 million credit union members

$1.9 billion contribution to gross domestic product

$229 million in direct member benefits

$9.5 billion in home loans

$58 million deposited in youth savings accounts

6,500 family wage credit union jobs

55,000 hours of community service by credit union employees

1,200 non-profits supported

Other Highlights

Credit Unions for Kids &

Doernbecher Days

Oversaw $62,183 in donations for Doernbecher Children’s Hospital through credit union, employee, and member donations. Total since 2010: $614,597.

Cash Club Cares Program

We donate $5 to animal shelters for each new youth account opened, up to $5,000 annual pledge. Total since 2017: $33,321.

Communities First Program

Continued our pledge to disburse $46,500 annually to seven community colleges and thirteen hospitals across our service areas. Total since 2018: $238,000.

Member Scholarships

Awarded seven scholarships totaling $11,000. Total since 1995: $247,500.

Grant Funds

$240,000 in grants to 15 community partners through Visa partnership and Member Impact Fund from Federal Home Loan Bank (FHLB) of Des Moines.

Christmas Tags

Partnered with foster care agencies in five counties to help provide gifts for children and teens. We raised $3,951 to purchase gifts and filled 210 tags for every foster child in Cowlitz and Wahkiakum counties.

Special Olympics

Coordinated a give-back event at our all-staff training day to assemble 350 goodie bags, each including a handmade inspirational card, for local Washington and Oregon Special Olympics athletes.

Department Donations

$16,688 in donations from our departments to community organizations.

Advocacy

$7,904 for America’s Credit Unions PAC, which provides bipartisan financial support to candidates and legislation that support credit union goals.

CEO & BOARD CHAIRMAN REPORT

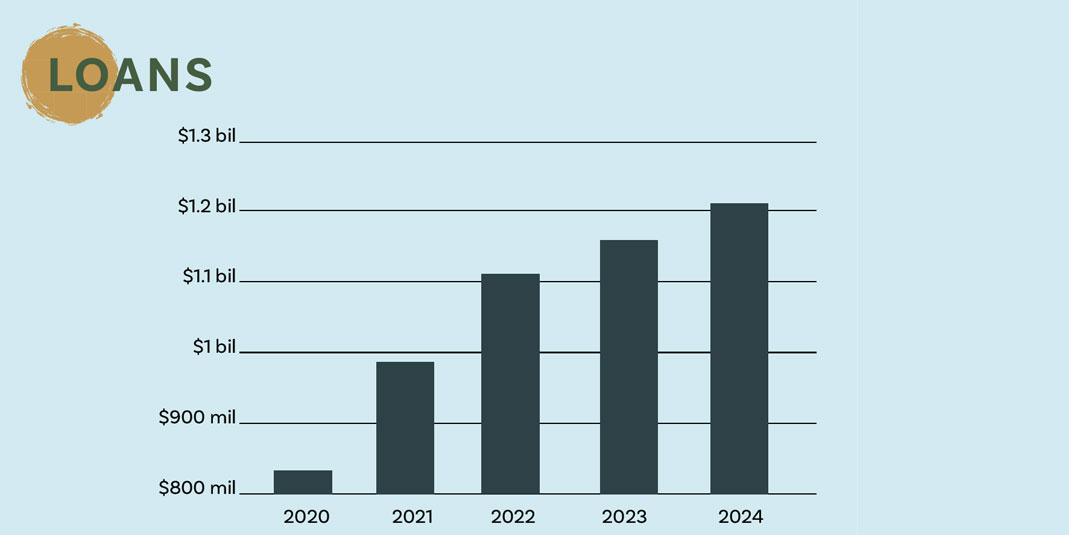

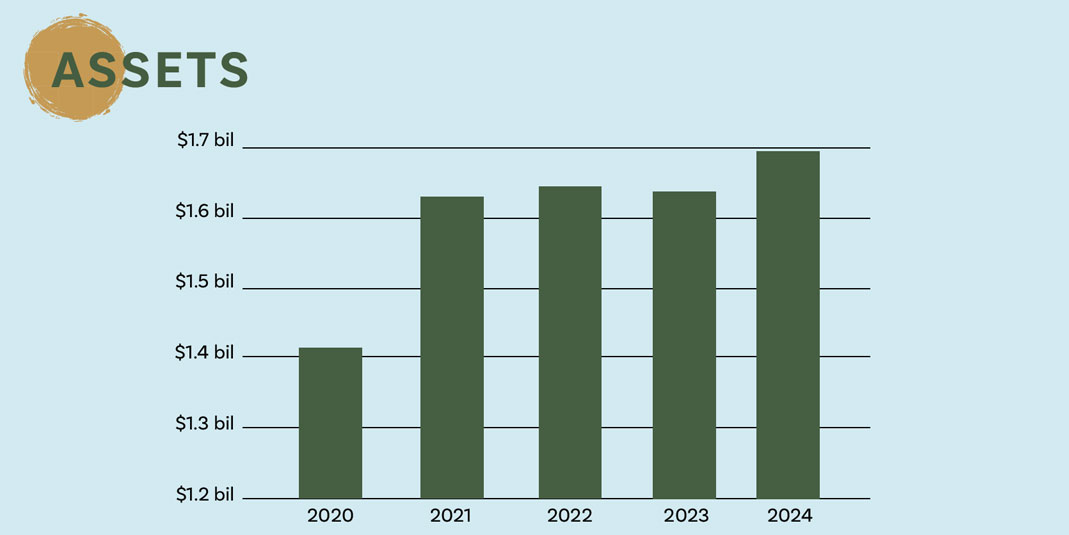

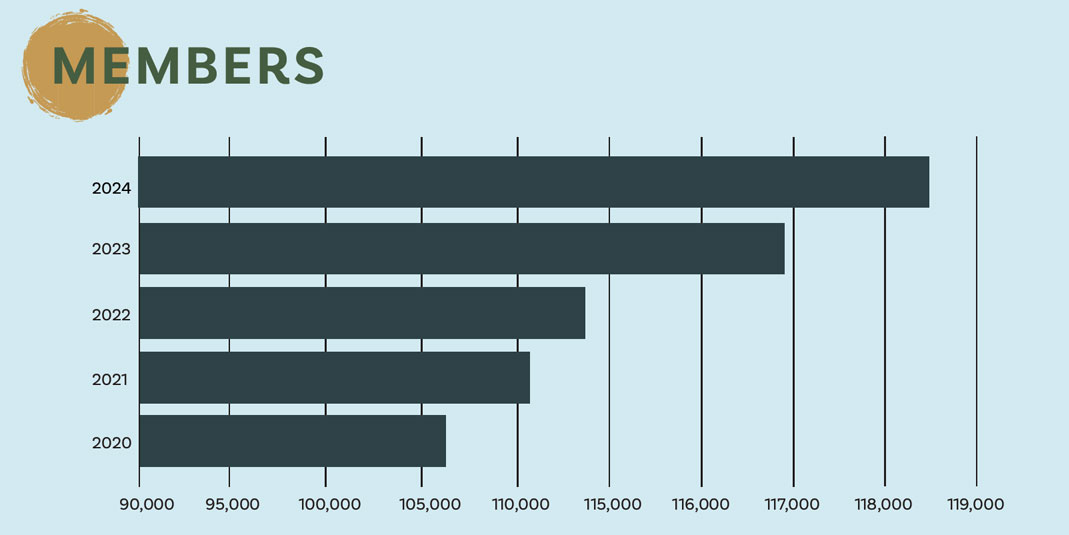

In 2024, Fibre Federal Credit Union and TLC experienced strong financial growth across multiple areas. Assets, membership, loans, deposits, and capital all increased, reflecting the trust and confidence our members place in us. However, challenges remain, as member loan delinquencies rose. Our Member Solutions team is dedicated to supporting our members as they navigate the growing debt challenges that many Americans are experiencing.

We entered our second year of an inverted rate environment, where long-term U.S. Treasury yields remain lower than short-term rates. The result: our short-term share certificate rates continue to be higher than longterm rates. Now more than ever, it’s worth savers’ time to compare rates across a range of terms.

A major milestone of 2024 was our purchase of the historic Longview Daily News building at 770 11th Ave. This 45,702-square-foot property on three acres will become a state-of the-art Member Digital Experience Center. This project underscores our commitment to the local community while enhancing our multi-channel service offerings.

This new facility will centralize our Contact Center staff, who currently operate from multiple locations. It will house our Virtual Representatives supporting our 28 Interactive Teller Machines (ITMs) across 11 counties, as well as phone, chat, and video services. Renovations began in 2024, with completion expected in 2025.

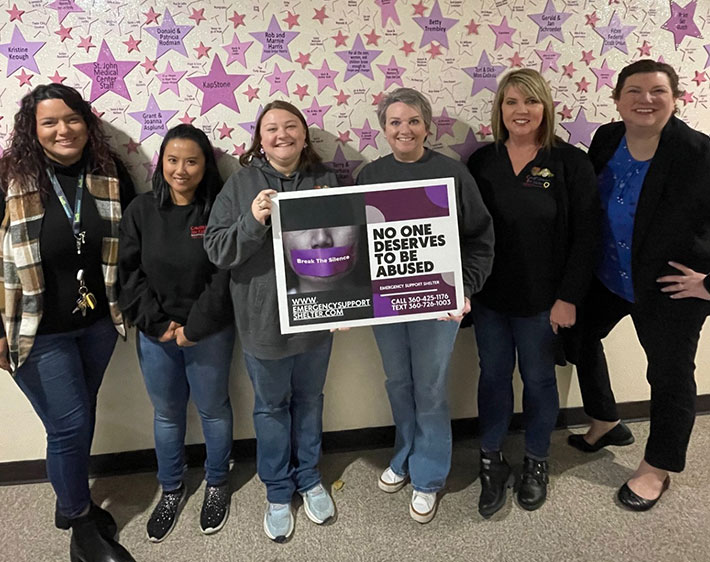

In partnership with Visa, we distributed $210,000 in grants to community organizations. Many recipients were hospitals in our Communities First Program, ensuring broad community benefits. Additionally, we secured a Federal Home Loan Bank of Des Moines 3:1 match grant, turning $10,000 in Visa grant funds into a $40,000 gift for the Emergency Support Shelter in Longview.

Fibre Federal Credit Union was honored with the Jack Henry Barrier Breaker Cobalt Award, recognizing our commitment to financial inclusion, thanks to our optimization of our Money Builder Share Certificate program. The award came with a $10,000 donation to Doernbecher Children’s Hospital.

To support financial wellness, we launched innovative products, including Flash Cash, an instant-approval, no-credit-check loan, and Drive4Less, a flexible vehicle financing option. We also introduced an online vehicle search tool and video appointments for mortgage and home equity loans.

Expanding digital support, we welcomed Fern, our virtual financial coach, in partnership with GreenPath Financial Wellness. Alongside Timber, our 24/7 chatbot, Fern provides members with guidance on debt management, credit building, and savings.

With a year of progress and innovation behind us, we remain dedicated to empowering our members and strengthening our communities. We look forward to another year of growth and service in 2025.

Christopher Bradberry

President/CEO

Jerry Howell

Board Chair

Financial Statements

Statement of Financial Condition 2024

| Dec 31, 2023 | Dec 31, 2024 | |

|---|---|---|

| Gross Loans | 1,158,601,338 | 1,203,447,034 |

| Allowance for Loan Loss | (10,918,123) | (12,956,779) |

| Net Loans | 1,147,683,215 | 1,190,490,255 |

| Cash & Equivalents | 151,002,638 | 226,704,226 |

| Investments | 221,175,365 | 160,100,783 |

| Cash and Investments | 372,178,003 | 386,805,008 |

| Foreclosures & Repossessions | 1,092,173 | 1,602,631 |

| Fixed Assets | 44,343,295 | 45,663,964 |

| Other Assets | 67,165,031 | 71,260,993 |

| Total Assets | $1,632,461,718 | $1,695,822,851 |

| Total Liabilities | 24,054,196 | 21,984,565 |

| Regular Shares | 606,704,247 | 593,172,709 |

| Checking Shares | 376,854,532 | 385,768,141 |

| Money Market Shares | 146,405,104 | 126,106,841 |

| Certificate Shares | 282,025,763 | 356,244,554 |

| Shares | 1,411,989,646 | 1,461,292,245 |

| Undivided Earnings | 205,590,231 | 217,923,926 |

| Other Comprehensive Income | (9,172,356) | (5,377,885) |

| Equity | 196,417,875 | 212,546,041 |

| Total Liabilities & Equity | $1,632,461,718 | $1,695,822,851 |

Statement of Income Expense 2024

| 2023 | 2024 | |

|---|---|---|

| Total Interest Income | 65,810,015 | 76,955,793 |

| Total Interest Expense | 14,199,149 | 20,321,476 |

| Net Interest Income | 51,610,866 | 56,634,317 |

| Fee Income | 6,340,322 | 6,362,601 |

| Other Income | 4,524,799 | 4,669,395 |

| Credit Card Program | 2,189,038 | 2,244,447 |

| Debit Card Program | 8,854,140 | 9,399,936 |

| Loan Origination Income | 575,059 | 781,560 |

| Non Operating Gain/Loss | 3,922,890 | 298,080 |

| Non Interest Income | 26,406,248 | 23,756,019 |

| Compensation & Benefits | 33,107,509 | 36,397,046 |

| Travel & Conference | 770,014 | 820,400 |

| Office Occupancy | 2,834,949 | 2,831,614 |

| Office Operations | 5,589,328 | 5,655,828 |

| Education & Promotion | 1,000,085 | 1,389,253 |

| Loan Servicing | 1,871,930 | 1,914,250 |

| Professional Services | 7,017,419 | 7,769,035 |

| Operating Fee | 271,383 | 256,299 |

| Misc Operating | 3,033,621 | 3,183,253 |

| Non Interest Expense | 55,496,237 | 60,216,979 |

| Acquisition Related | (181,161) | (181,161) |

| NCUSIF Refund | 27,999 | 0 |

| Provisions for Loan Losses | (7,266,396) | (7,658,503) |

| Net Income | $15,101,319 | $12,333,695 |

SUPERVISORY COMMITTEE REPORT

Your Supervisory Committee is comprised of five volunteers: Jeff Skeie, David Thelin, Greg Kelly, Alison Peters, and Gabe Negrete. The 2024 Supervisory Committee was also joined and assisted by Supervisory Committee Associate Members Jamie Foster and Danielle Wheeler. The Supervisory Committee has the responsibility to oversee and verify that the Credit Union has developed and maintains an internal control framework that provides reasonable assurance to the reliability and integrity of the financial statements and compliance with laws and regulations.

Your Supervisory Committee fulfills this responsibility in two ways. We meet regularly with the Credit Union’s Vice President of Internal Audit, Luci Sherard, who assists the Committee in verifying compliance within our internal control framework. We also engage an external audit firm, Moss-Adams, to audit the financial statements and the operational controls surrounding those financial statements in accordance with generally accepted auditing principles.

Supervisory Committee members attend regular monthly Supervisory Committee meetings, as well as monthly meetings of the Board of Directors. At these meetings we review the work of the Internal Auditor, the external auditor, and management to ensure that the Supervisory Committee’s responsibilities are properly discharged.

Based on our audits and the reports of other experts, the Supervisory Committee is satisfied that the records of Fibre Federal and TLC are accurately maintained, and the Credit Union is in compliance with applicable laws and regulations. We thank the Credit Union management and staff for their diligent work that ensures such a well-run organization.

Jeff Skeie,

Supervisory Committee Chair

BOARD OF DIRECTORS

Jerry Howell, Chair

Jim Duscha, 1st Vice Chair

Kelli Harding, 2nd Vice Chair

Ashley Lachney, Secretary

Steve Mealy, Director

Jack Courtney, Director

Greg Berg, Director

Julie Palmer, Director

Bart Finnel, Director

SUPERVISORY COMMITTEE

Jeff Skeie, Chair

David Thelin, Secretary

Greg Kelly, Member

Alison Peters, Member

Gabe Negrete, Member

Jamie Foster, Associate Member

Danielle Wheeler, Associate Member

EXECUTIVE MANAGEMENT TEAM

Christopher Bradberry, President/Chief Executive Officer

Shelly Buller, EVP/Chief Operations Officer

Ryan Sullivan, EVP/Chief Delivery and Revenue Officer

Angie Shipman, SVP/Chief Experience Officer

David Keegan, SVP/Chief Information Officer

Meghan Staup, SVP/Chief Financial Officer